#3 Income Tax

This article is to share some of my knowledge and understanding about some of the commonly encountered terms related to income tax and income tax returns.

I am sure almost everyone would have encountered a situation of being asked for your PAN by an employer or some entity that is paying you money.

Why exactly do they ask your PAN and what do they do with it?

What do they mean by saying that they have “deducted some amount as tax”?

How to check or ask for proof if they have genuinely paid the deducted tax amount to the IT department?

Though it might not be of great use to everyone to know about these things now, it is always good to be familiar and to realize if you are being cheated by your payer. Like they say - “It is not a shame to be deceived, but it is to stay in the deception”

So let’s get into the topic to find out the answers :)

Tax Deducted at Source (TDS)

You would have come across this acronym TDS very frequently in discussions about taxation. As the full form says, it is basically the tax deducted by the payer from the income that he is paying you. The payer will pay this TDS deducted, on your behalf, to the IT department while filing their quarterly returns. The payer needs your PAN for this reason because PAN is your ID for the Income Tax department.

The percentage of income deducted as TDS is different for different types of income like salary, interest on money deposited, gifts, etc. There are also cases where TDS is not deducted by submitting some exemption forms (like Form 15G/H) or for some other reasons. Such exemptions are very case-specific and I am not giving any details about them.

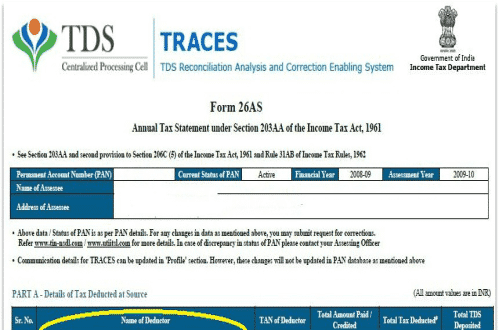

Tax Credit Statement a.k.a Form 26AS

As the name suggests this form will have the details about your income and tax that has been received by the IT department from you or on your behalf. This is an annual statement having all your incomes and any taxes deducted in a particular financial year. This is the form where you can check if the deducted TDS has actually been credited to the IT dept. Form 26AS can be accessed at any time in the year in two ways (as of my knowledge) :

- From internet banking of specified banks

- From IT e-filing website

Form 16

This form is issued by the entity that is paying you at the end of a financial year or quarter.

This form will have the same details as that of Form 26AS but it is issued by the payer and will have info about his payments to you. Form 26AS on the other hand will have info from all your payers in one place and is generated by the IT dept. If someone asks for your PAN for the reason that they paying you, you have the right to ask them for Form 16.

Income Tax Return

You might now think if your income is below the taxable income threshold and the payer has deducted TDS, can you do something about it or just accept it and be quiet?

Of course, you can do something. It is the payer’s responsibility to deduct TDS, so you really can’t question the payer. For this reason, you have to file IT returns annually. TDS and other deductions are made without having any idea of what your income would be at the end of the year.

While filing Income Tax Returns, you consolidate your earnings in a year and the net tax payable is computed. If the TDS collected is more than the net tax, you are eligible for a refund (along with interest from the date of deduction). If the TDS collected is lesser than the net tax computed, you have to pay the rest of the amount.

I hope this article added some value to your knowledge about income tax.