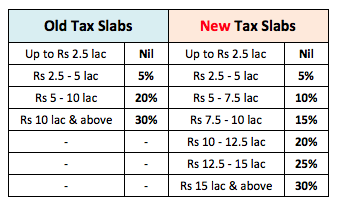

Comparing the old and new tax regimes¶

Old Tax Regime¶

- Standard deduction of 50,000/-

- Deductions under 80C are assumed to be fully utilised i.e, 1,50,000/-

- Employee's self-contribution towards NPS under 80CCD(1B) of 50,000/-

- Employer's contributions towards NPS is assumed to be zero, however can be given as a parameter to the function old_tax_regime(gross_income,employer_pf,employer_nps)

- HRA, LTA and other exemptions are not considered

PF contribution by the employer is assumed to be 12% of the gross income, however can be changed in the function's parameters

Conclusion: The old tax regime seems to be beneficial assuming that you avail all the main deductions possible¶

In [1]:

def old_tax_regime(gross_income,employer_pf,employer_nps):

income = (gross_income-employer_pf)/1e5 #income in lakhs

#Standard deduction : 50k

income += -0.5

#80C deductions : 1.5lac

income += -1.5

#80CCD(1b) : NPS self-contribution : 50k

income += -0.5

#80CCD(2) : Employer NPS contribution : max 10% of gross_income

income += -employer_nps/1e5

tax = 0

if income>10 :

tax = 0.05*2.5 + 0.2*5 + 0.3*(income-10)

elif income>5:

tax = 0.05*2.5 + 0.2*(income-5)

elif income>2.5:

tax = 0.05*(income-2.5)

return tax

def new_tax_regime(gross_income,employer_pf,employer_nps):

income = (gross_income-employer_pf)/1e5 #income in lakhs

#80CCD(2) : Employer NPS contribution : max 10% of gross_income

income += -employer_nps/1e5

tax = 0

if income>15 :

tax = (0.05+0.1+0.15+0.2+0.25)*2.5 + 0.3*(income-15)

elif income>12.5:

tax = (0.05+0.1+0.15+0.2)*2.5 + 0.25*(income-12.5)

elif income>10:

tax = (0.05+0.1+0.15)*2.5 + 0.2*(income-10)

elif income>7.5:

tax = (0.05+0.1)*2.5 + 0.15*(income-7.5)

elif income>5:

tax = 0.05*2.5 + 0.1*(income-5)

elif income>2.5:

tax = 0.05*(income-2.5)

return tax

In [2]:

incomes = [9e5,10e5,11e5,12e5,13e5,14e5,15e5,16e5,17e5,18e5,19e5]

for i in incomes:

old = int(1e5*(old_tax_regime(i,0.12*i,0)))

new = int(1e5*(new_tax_regime(i,0.12*i,0)))

print("%d lakhs gross -- old: %d -- new: %d"%(i/1e5,old,new))